How Will Fed Policy Affect Mortgage Rates?

It's not as straight forward as many think.

Now that the Fed has started their second easing cycle since their inflation fight, many people are relieved that mortgage interest rates will finally start to come down providing relief for a frozen and unaffordable housing market. That is what the President has argued will happen, and it is what many people likely expect. Is that assumption correct?

Historically it has typically been correct, but not because the mortgage rates follow the Fed. Mortgage rates most closely follow the 10-year bond. 10 years is a much longer term than the Fed Funds rate which is the rate banks pay each other when they need to borrow excess reserves from other banks in the overnight federal funds market. Overnight borrowing costs are not really comparable to 10-year borrowing costs. The reason these rates have typically tracked more closely in the past is that the Fed was lowering rates in response to already very weakening economic conditions which would drive up the demand for the safety of longer-term bonds thereby lowering their rate.

Is that what is happening this time? Well it is not exactly clear. The Fed is stuck between inflation which is proving to be just a little bit sticky here around 3% and a labor market that is starting to show some signs of weakness but is still far from a poor labor market with unemployment at a still historically low 4.3%. 4.3% is barely above the range of 4.0%-4.2% that the unemployment rate has been in for the last year.

So the real question is how do people who are buying the 10-year bond feel about the future of the job market, the future of the U.S. economy, and the future of inflation? The only way to know how they currently feel about that is to look at the 10-year bond rate. Ever since the Jackson Hole speech from Fed Chairman Jerome Powell where he hinted that the Fed may start to lower rates in response to a weakening labor market the bond market has lowered interest rates about a quarter of a percent, taking the 10-year bond down to a low of 4.0% This is the same amount that the Fed eventually cut rates at their September 17th meeting. On the surface this might seem to indicate that bond and mortgage rates are tracking the Fed. However this reduction in rates in the bond market was heavily tied to the weakening labor market data which had been bad for the better part of a month. In the last few weeks though, that data has looked a little less weak as the first time unemployment claims improved and consumer confidence and spending continued to hold up. This caused the bond market rates to start to rise, and it started to do so even before the Fed cut.

In fact by the time the Fed cut rates the 10-year bond had already risen from 4.0% back to 4.07% and after they cut they kept rising even further up to 4.15% as of a few days ago. The Fed cut a quarter of a percent and the 10-year bond rose off the bottom by 15 hundreds of a percent. The point of these examples is to show how the bond and mortgage market move in response to multiple stimuli and will move irrespective of what the Fed does to the one primary short-term interest rate that it can control.

In the last couple days in response to the government shutdown and concerns about that weakening the economy the 10-year bond has dropped back down below 4.10%. So we can see again that the 10-year bond is moving in response to the perceived strength of the economy and not in response to expectations about future Federal Reserve interest rates. In fact the shutdown could act to help the mortgage market if it were to weaken the economy just enough to bring mortgage rates a little lower. These things tend to be complicated and interconnected. What may seem damaging on the surface could be beneficial in some respects at least as it relates to potential interest rates.

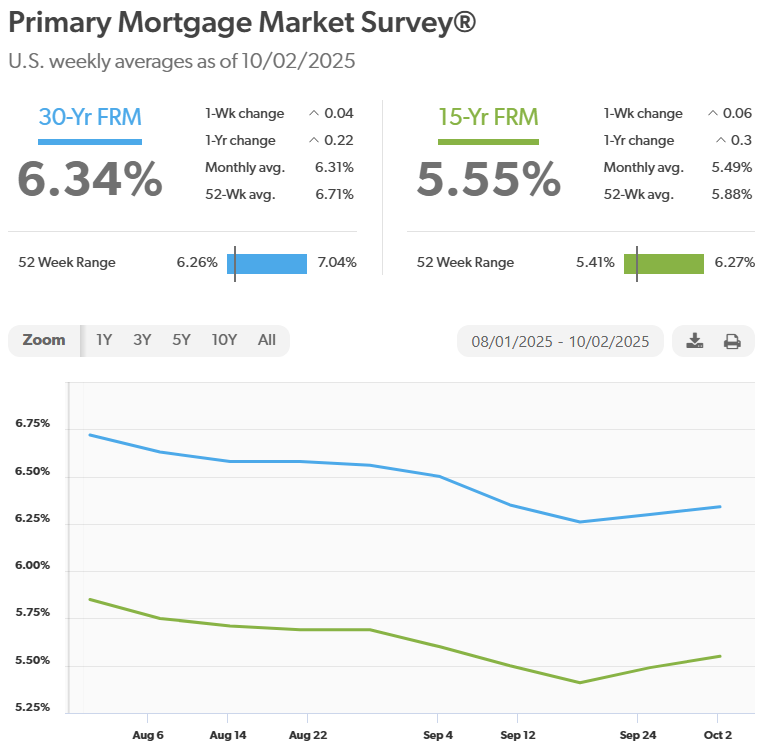

The chart below shows that mortgage rates are tracking exactly the 10-year bond pattern just as would be expected and not the Fed Funds rate. The mortgage rates bottomed on September 18th almost the exact day of the Federal Reserves interest rate cut and have moved higher since then in conjunction with the 10-year bond doing the same.

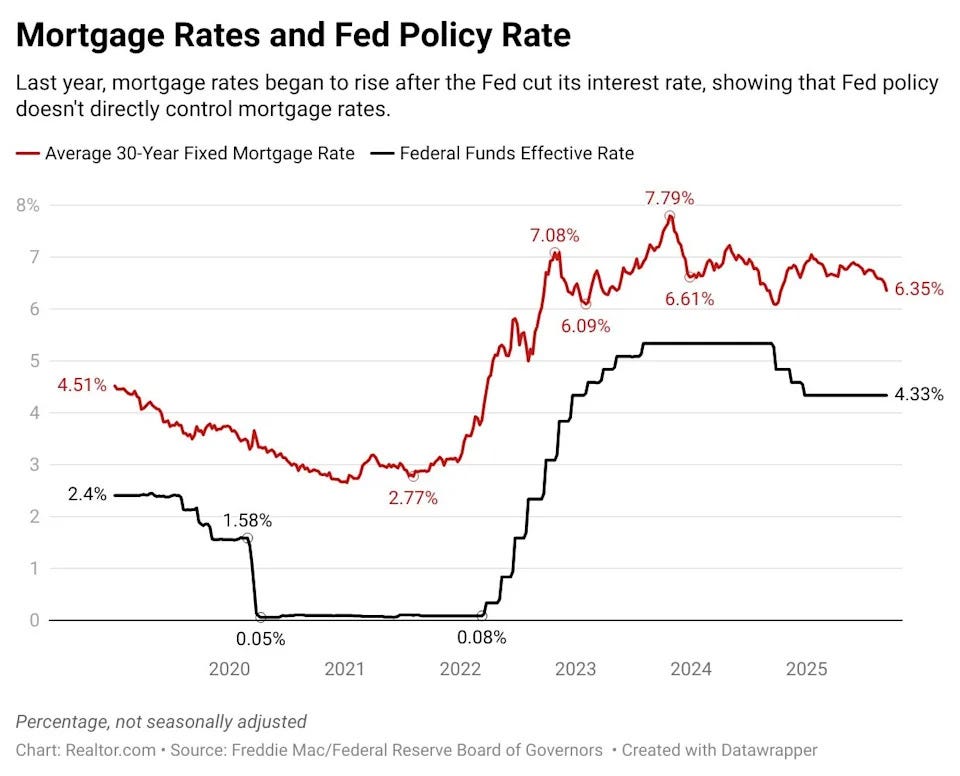

In fact we saw exactly the scenario where mortgage rates moved up while the Fed lowered interest rates during their previous easing cycle just last year. Below is a chart showing the changes in the Federal Funds Rate as well as the movement of the 10-year Treasury Bond and the 30-year mortgage rate which tracked a little bit more than 2% above the 10-year Treasury Bond. It is doing the same now with the 10-year bond at about 4.1% and the 30-year mortgage rate at about 6.3%.

We can see that over a period of 4 months at the end of 2024 the Federal Reserve lowered the Federal Funds rate a full percent point. during that same 4 month period both the 10-year Treasury Bond and the 30-year mortgage rate increased slightly less than one percent point. What is the explanation for this divergence of interest rate moves between the Federal Funds rate and the mortgage rate?

For one thing the market is usually well out in front of the Fed. It anticipates what the Fed and the economy are going to do before they do it which is why we can see on this 5-year chart that the market usually moves mortgage rates prior to the Fed rate changes. However, the continuation of that move depends on the market’s assessment of the long-term economic health of the economy. We can see in early 2024 the market lowered rates ahead of the Fed, but then just when the Fed started lowering rates the market reversed the mortgage rates higher.

Another thing we can see from the chart of data posted above is that the inflation rate was actually increasing during this time. In addition the job market had been weak and some people felt was flashing some warning signs about a possible recession. It had violated the Sahm rule, but there were reasons based on pandemic disruptions to believe that violating the Sahm rule likely did not portend a recession this time. Even the creator of the rule herself, Claudia Sahm, said exactly the same thing. However the market was worried about it, and that is when bond traders drive up bond prices which brings down bond rates. In the months during which the Fed was lowering rates, the unemployment rate was slightly recovering, the economy was slightly strengthening, inflation was increasing, and the Sahm rule reversed. It became clear that no recession was coming and the labor market was in a better spot than anticipated.

The Fed stopped lowering the Federal Funds interest rate at the beginning of 2025, and the market based interest rates had already been out in front of the Fed anticipating that the labor market and the economy were actually doing just fine. The result of what the market learned was that it took bond rates and mortgage rates nearly 1% higher even while the Fed took its interest rate 1% lower.

Will that repeat itself again in the last 4 months of 2025? The answer to that is unknown. Of course home buyers, sellers, and builders certainly hope it does not, but contrary to what too many people want to believe that outcome does not depend on the Fed at all. It depends on the economy, the job market, and future inflation. That is what the market will be using to determine what price it is willing to pay for long-term bonds, and that will set the future mortgage rate.

For mortgage rates to go meaningfully lower, something about the economy will need to get weaker. Bond rates and mortgage rates generally do not go down in the face of a strengthening economy.