The Fed Starts to Ease Again

But a tornado of controversy swirls around them.

Just like they did one year ago, the Fed has now started a second easing cycle to further reduce the restrictive nature of interest rates on the economy. This time though they did not start with the larger 50 basis point cut that they did last year. They start with a modest 25 basis cut that was mostly expected.

There was nothing surprising about the move as it had been telegraphed ever since Powell’s speech at Jackson Hole where he mentioned that it may be time to adjust policy in response to a weakening job market. That’s as close to announcing a cut as you are going to get out of the Fed.

While the cut was not surprising there were still probably more other unanswered questions and uncertainty about this meeting than any previous meeting in at least the last year.

That uncertainty was fueled by a host of somewhat extraordinary events.

Would Governor Cook be allowed to participate in this meeting? There were still questions about her status a sitting Fed Governor given that the President had tried to fire her for supposed mortgage fraud based on some primary residence claims on previous mortgage documents. The issue is still being fought in the courts, but on Monday a U.S. Court of Appeals ruled that Governor Lisa Cook could not be fired while her appeal was still pending. This meant that Governor Cook could participate and vote in the meeting this week on interest rates. How would she vote given the controversy surrounding her future employment at the Fed?

What would be the influence of the newly appointed Fed Governor? Also on Monday the Senate confirmed Trumps appointment of Stephen Miran as a new Fed Governor on the Federal Reserve Board. Miran was the chairman of the President’s Council of Economic Advisors. He took a leave of absence from that position but did not resign. As such he still holds a position in the current administration while also serving on the Federal Reserve. That has never happened before, but it did not stop the Senate from confirming him. There were questions about his ability to serve independently without being influenced by the administration he was still a member of. How would he vote on the committee?

Would there be a considerable division among the board with many votes against the policy choice? Governors Waller and Bowman had already expressed a desire to start moving rates lower sooner and perhaps quicker than expected. Would they vote against the majority arguing for a larger cut? There are other members on the committee who do not seem to think a cut is really needed yet. Would they vote against the majority arguing for no cut?

All the uncertainty ended up melting away and we got a fairly non-controversial outcome from the Fed Board. One wonders if they didn’t realize the microscope they were under and wanted to be careful to send the message that inspite of all the controversy that was being injected into the workings of the Federal Reserve exclusively from the Administration that they were going to show that they were nearly unfazed by all of it.

Powell was even asked a few questions during the press conference about these topics. He simply refused to comment on some of them and on others he was careful and direct in emphasizing that Fed is an entirely independent body that does not think about all of these other issues that are circling around it when they make their policy decisions. He said it simply does not ever enter the discussion or the consideration.

Of course we can never be truly sure of that, but he and the committee did their best at this meeting to show exactly that.

Cook was at the meeting. We heard nothing from her and she voted with the committee for a quarter point cut.

We learned that Miran argued for a larger cut of 50 basis points and he was the sole vote against the 25 basis point cut since he wanted a larger cut in line with the goals of the Administration. No one was surprised by this. He has played his hand as an administration plant but the rest of the committee is working hard to appear unified against a sole outside influence.

Waller and Bowman voted for the 25 basis point cut and did not argue for more even though they had been more dovish previously. Other committee members who may have been content to not cut voted for the 25 basis point cut and did not specifically argue for less.

During the press conference there was a lot of talk about a slower employment market as Powell started to shift away from a focus on inflation. He even stated that while inflation expectations were somewhat elevated for the next year, that beyond the next year the expectations are consistent with their long run goal of 2% inflation.

He also said of the labor market that it was, “low firing, low hiring and if you start to see layoffs that would quickly flow into unemployment because the hiring rate is so low and it is one of the reasons why we think it is appropriate to shift our policy stance to a more balanced one.”

His emphasis was not on recovery but on balance, and he framed the move as a move away from a restrictive interest rate policy to one that was moving in the direction of a neutral policy. The use of direction in that statement is also one that implies further cuts but does not imply a timetable.

He also admitted that they were in a situation where we have two-sided risk and that means there is no risk free path.

There is no easy answer to what is the correct choice here. The dual mandate is in conflict so mitigating the risk to one side by definition increases the risk to the other side of the mandate.

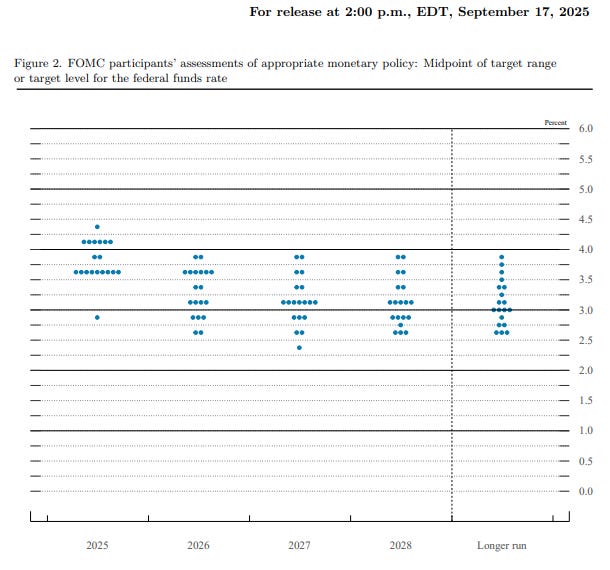

The final interesting piece of information was the quarterly dot plot. In June the dot plot showed expectations for 2 cuts this year but was very close to showing three. With the addition of Miran to the voting committee the dot plot shift by exactly 1 vote to show a very slight expectation of 3 cuts this year which would mean 2 more.

The interesting thing is that Miran didn’t even appear to try to hide his outside influenced approach. When you see the dot plot there is one new dot that was not there in June that is 75 basis points below every other dot on the plot expecting another 125 basis points in cuts at the final two meetings of the year. The dot plot is anonymous so we don’t know whose dot that is, but very few people have much doubt.

It will be interesting to watch the Fed in the coming weeks to see how much they try to project a unified front. I think most of them feel that is more important now than it has been in a long time.

Thanks for the summary. It helps shape my thinking about how the economy could progress the rest of the year.