The Tariff Battle Between Inflation & Jobs

Tariffs are hitting the economy harder than prices right now.

The July inflation report showed inflation was just a little bit better than expected. It is still not fully cooperating, but it is continuing to be in the middle ground between fully solved and not quite going away.

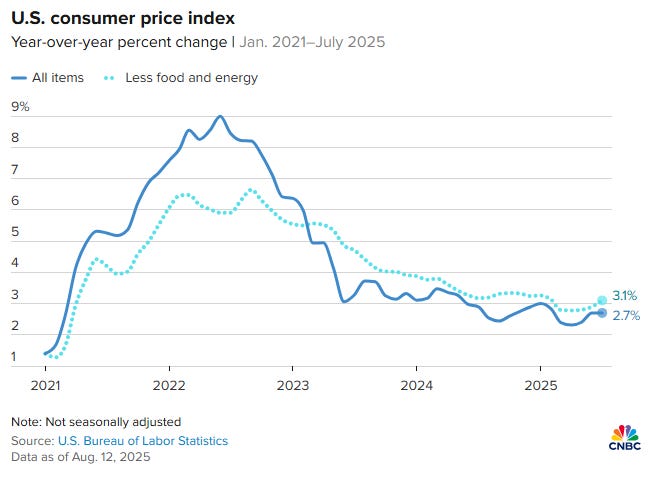

The data were as follows:

Monthly CPI rate of 0.2% as expected.

Annual CPI rate of 2.7% which was flat from June and below the 2.8% that was expected.

Monthly Core CPI rate of 0.3% as expected.

Annual Core CPI rate of 3.1% which was up from 2.9% in June and above the 3.0% expected.

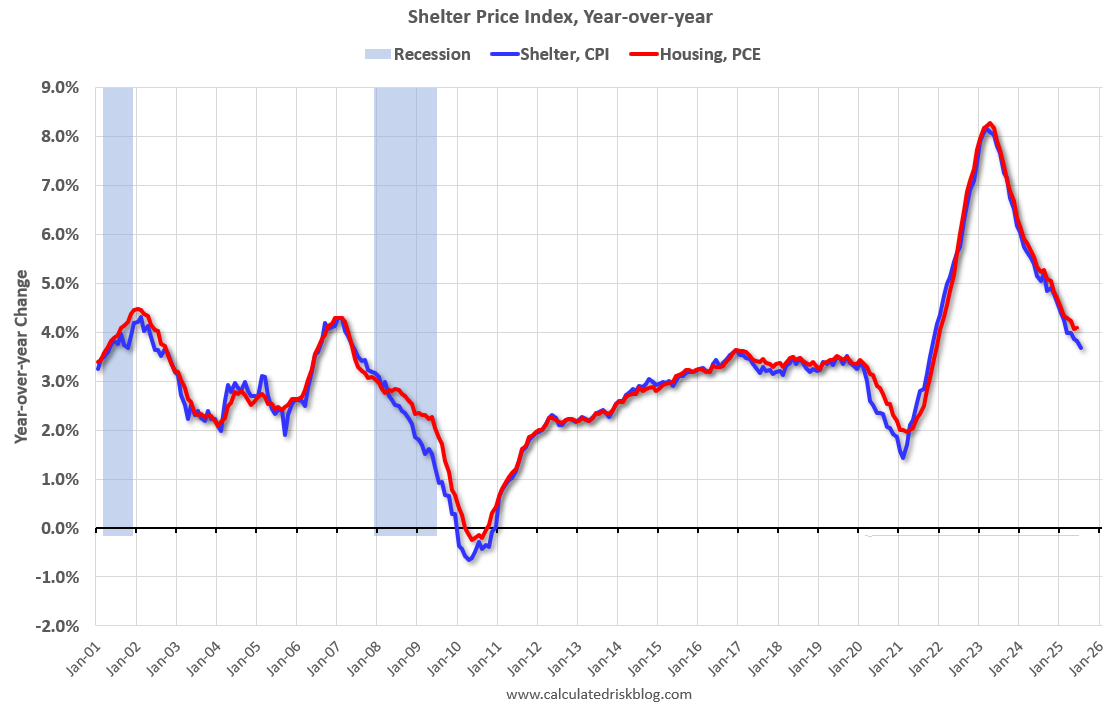

I also want to keep posting this housing inflation chart:

I know I keep harping on this, but that is because housing inflation has been something people have been wringing their hands about for a very long time because of the long lag in the inflationary effects. Shelter CPI dropped again this month and is now down to 3.7%. It just keeps inching down nearly every month. It is now effectively equal to the same number that it had posted in 2017 and it is going to just keep heading down to the 3% area over the next year that was the normal range for much of the previous decades. The lesson from this is to have a broader view than just what talking heads are focusing on in the rear view mirror or even out the side window. With many of these things you have to look out the windshield far down the road to the next bend and even beyond it based on what you know about the landscape. Housing was always heading towards this path but very few were willing to look ahead and see it.

So with that reminder, we need to look ahead on both the inflation and jobs front to what is likely coming next based on what we know about the current landscape. That landscape is being most impacted by tariffs right now, so we need to assess what tariffs typically do and what they appear to be doing this cycle.

Tariffs continued to have a modest impact on these inflation numbers but not an overwhelming impact. Every economist knows that tariffs raise prices but most believe those impacts have a one-time effect after which prices settle into a new normal rather than feeding on themselves in an inflationary spiral. This generally makes sense if the tariff rates stabilize. It also takes some time for this stabilization to happen, so again we need to look far out the windshield and not just in the rear view mirror like most are inclined to do.

Tariffs also impact the economy. As such tariffs generally have a two pronged impact as they are also doing here. Importers are slowly raising prices as they realize the tariffs are here to stay. This will continue to put modest upward pressure on the inflation numbers. The larger impact for now though appears to be a cooling and in some cases freezing effect on the business climate and the job market. Businesses just don’t know how to plan for the future in this uncertain environment. When faced with that uncertainty, businesses tend to get more conservative. They have not yet resorted to very many lay offs but many have stopped hiring which is starting to show up in labor market data. If the economy cools further, layoffs could follow.

We are now starting to get just enough data to deduce that the tariffs appear for now to be hitting the economy a bit harder than they are hitting prices. The price impact is likely to continue to filter in and keep the inflation rate from improving much at all in the near future, so this inflation rate near 3% is probably about as good as we can expect for a while. It probably doesn’t get a whole lot worse than being in the 3% range, but it doesn’t look like it’s going to get much better either.

3% CPI is the inflation world we can expect for right now.

So where does that leave the Fed? I think it leaves them with enough data and enough cover to start cutting rates. They can see what the data is telling them as well as anyone else. It appears to be telling them that right now the impact of tariffs is heavier on the economy than it is on prices. The Fed has admitted that rates are still somewhat restrictive. Given that tariffs are compounding that restriction it would appear to be time to at least remove the excess restriction that they admit rates are still applying to the economy.

They need to shore up the economy first. The Fed did an absolutely amazing job of halting inflation with a soft landing that did not cause a recession. Almost no one thought they could accomplish that, and yet they did and get very little credit for it. They may have been a little late which just makes the soft landing that much more impressive. Unfortunately the job they did is likely to get lost and overshadowed by the self-inflicted wound the administration’s tariffs are imposing on the economy.

The Fed is likely to be blamed from multiple angles for everything from this modest reversal in inflation to the slowing job market. Don’t you believe it! The economic villain here is unequivocally the rapid advent of tariffs. Without these tariffs the job market would be stronger, the economy would be stronger, and inflation would be lower. The Fed simply got us out of the frying pan only to be thrown right back into the fire because of tariffs. This time their job is tougher because they can’t fight inflation and a slowing economy at the same time.

The Fed has always said they are data dependent. The current data is saying inflation is still somewhat ok , but the job market may be in trouble. That implies they need to shift their focus to the other half of their mandate. When looking at economic, job, and inflation data in totality, it indicates a rate cut should be coming soon, likely in September.

Thank you for your analysis.

Another insightful analysis. Thank you.